Investment Optimization with Nonlinear Equation Solving

DOI:

https://doi.org/10.63876/ijss.v1i4.61Keywords:

Investment optimization, Nonlinear equations, Optimal asset allocation, Financial decision-making, Investment sensitivity analysis, Optimal portfolioAbstract

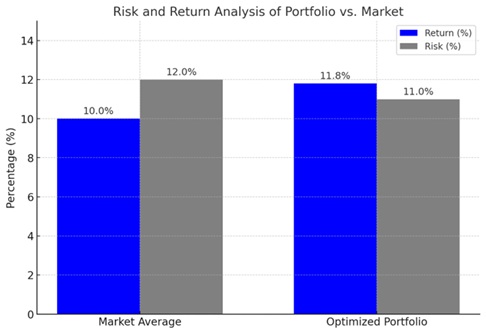

Investment optimization is one of the important topics in the world of finance that aims to maximize profits with minimal risk. Mathematical approaches, particularly through the solution of nonlinear equations, have become an effective method of aiding investment decision-making. This article discusses the development of an investment optimization model that uses nonlinear equation solving techniques to determine optimal asset allocation. In this study, a nonlinear equation is used to describe the relationship between various investment variables, such as profit level, risk, and asset allocation. Using this approach, investors can find optimal solutions that meet their investment goals, whether in conservative, moderate, or aggressive scenarios. The methodology used involves historical data analysis, mathematical model formulation, and the application of numerical algorithms to solve the nonlinear equations. The results show that the solution of nonlinear equations is able to provide a more precise solution than traditional methods, such as linear programming or simple heuristic. This approach not only improves accuracy in determining the optimal portfolio, but also provides flexibility in dealing with dynamic market conditions. The proposed model allows sensitivity analysis to variable changes, allowing investors to make more informative and adaptive decisions. Investment optimization with the solution of nonlinear equations is a significant innovation in the field of finance, which not only supports investment efficiency but also opens up opportunities for the development of more complex investment models. This article is expected to be a reference for academics and practitioners in applying a mathematical approach for optimal portfolio management.

Downloads

References

İ. Yarba, “Does the inverted U-shape between corporate indebtedness and investment hold up for emerging markets? Evidence from Türkiye,” Borsa Istanbul Rev., vol. 23, pp. S75–S83, Dec. 2023, doi: https://doi.org/10.1016/j.bir.2023.11.002.

J.-S. Chou and K.-E. Chen, “Optimizing investment portfolios with a sequential ensemble of decision tree-based models and the FBI algorithm for efficient financial analysis,” Appl. Soft Comput., vol. 158, p. 111550, Jun. 2024, doi: https://doi.org/10.1016/j.asoc.2024.111550.

Saluky and A. Fathimah, “Optimizing Household Energy Consumption Using Numerical Approaches to Reduce Costs and Environmental Impacts,” Int. J. Smart Syst., vol. 1, no. 3, pp. 117–124, Aug. 2023, doi: https://doi.org/10.63876/ijss.v1i3.14.

M. Chibane and P. Six, “Dynamic asset allocation and consumption with the indirect utility function,” Financ. Res. Lett., vol. 65, p. 105542, Jul. 2024, doi: https://doi.org/10.1016/j.frl.2024.105542.

Fadila Akmalia Wardani, Rifka Khairunisa, and D. S. Dede Setiawan, “Modeling the Movement of Autonomous Vehicles with the Euler Method,” Int. J. Smart Syst., vol. 1, no. 3, pp. 144–151, Aug. 2023, doi: https://doi.org/10.63876/ijss.v1i3.31.

J. Deepho, A. H. Ibrahim, A. B. Abubakar, and M. Aphane, “Hybridized Brazilian–Bowein type spectral gradient projection method for constrained nonlinear equations,” Results Control Optim., vol. 17, no. July, p. 100483, 2024, doi: https://doi.org/10.1016/j.rico.2024.100483.

M. J. Mungal, A. Singh, C. J. Ramlal, and J. Colthrust, “Sensitivity analysis of the unit commitment problem to guide data acquisition investments in a small island developing state: A case study,” Results Eng., vol. 18, p. 101191, Jun. 2023, doi: https://doi.org/10.1016/j.rineng.2023.101191.

X. Yang, M. Liu, J. Wei, and Y. Liu, “Research on investment optimization and coordination of fresh supply chain considering misreporting behavior under blockchain technology,” Heliyon, vol. 10, no. 5, p. e26749, Mar. 2024, doi: https://doi.org/10.1016/j.heliyon.2024.e26749.

H. S. Celil, B. Julio, and S. Selvam, “Investment sensitivity to lender default shocks,” J. Corp. Financ., vol. 79, p. 102311, Apr. 2023, doi: https://doi.org/10.1016/j.jcorpfin.2022.102311.

M. H. Rasheed, A. Ali, and N. A. Khan, “Technological advancements and noise trading: A case of investors’ sentiments at the Pakistan Stock Exchange,” Comput. Hum. Behav. Reports, vol. 12, p. 100344, Dec. 2023, doi: https://doi.org/10.1016/j.chbr.2023.100344.

B. Hu and G. Hong, “Management equity incentives, R&D investment on corporate green innovation,” Financ. Res. Lett., vol. 58, p. 104533, Dec. 2023, doi: https://doi.org/10.1016/j.frl.2023.104533.

S. Singh Rawat, Komal, H. Dincer, and S. Yüksel, “A hybrid weighting method with a new score function for analyzing investment priorities in renewable energy,” Comput. Ind. Eng., vol. 185, p. 109692, Nov. 2023, doi: https://doi.org/10.1016/j.cie.2023.109692.

A. Jose Valdez Echeverria, J. Palacios, C. Cerezo Davila, and S. Zheng, “Quantifying the financial value of building decarbonization technology under uncertainty: Integrating energy modeling and investment analysis,” Energy Build., vol. 297, p. 113260, Oct. 2023, doi: https://doi.org/10.1016/j.enbuild.2023.113260.

E. F. E. Atta Mills, S. K. Anyomi, U. Koumba, Z. Zhong, and Y. Liao, “Optimal allocation for stock market-excluded retirees: Effects of interest rates, longevity risk, and upfront fees,” Financ. Res. Lett., vol. 70, p. 106320, Dec. 2024, doi: https://doi.org/10.1016/j.frl.2024.106320.

N. Latif, R. Rafeeq, N. Safdar, K. Younas, M. A. Gardezi, and S. Ahmad, “Unraveling the Nexus: The impact of economic globalization on the environment in Asian economies,” Res. Glob., vol. 7, p. 100169, Dec. 2023, doi: https://doi.org/10.1016/j.resglo.2023.100169.

X. Qiang, Y. Hu, Z. Chang, and T. Hamalainen, “Importance-aware data selection and resource allocation for hierarchical federated edge learning,” Futur. Gener. Comput. Syst., vol. 154, pp. 35–44, May 2024, doi: https://doi.org/10.1016/j.future.2023.12.014.

S. T. Baidoo, B. Tetteh, E. Boateng, and R. E. Ayibor, “Estimating the impact of economic globalization on economic growth of Ghana: Wavelet coherence and ARDL analysis,” Res. Glob., vol. 7, p. 100183, Dec. 2023, doi: https://doi.org/10.1016/j.resglo.2023.100183.

J. Jang and N. Seong, “Deep reinforcement learning for stock portfolio optimization by connecting with modern portfolio theory,” Expert Syst. Appl., vol. 218, p. 119556, May 2023, doi: https://doi.org/10.1016/j.eswa.2023.119556.

Z. Rasool, S. Aryal, M. R. Bouadjenek, and R. Dazeley, “Overcoming weaknesses of density peak clustering using a data-dependent similarity measure,” Pattern Recognit., vol. 137, p. 109287, May 2023, doi: https://doi.org/10.1016/j.patcog.2022.109287.

D. Wang, Z. Gao, and D. Wang, “Distributed finite-time optimization algorithms with a modified Newton–Raphson method,” Neurocomputing, vol. 536, pp. 73–79, Jun. 2023, doi: https://doi.org/10.1016/j.neucom.2023.03.027.

S. Ben Yahya, H. El Karout, B. Sahraoui, R. Barillé, and B. Louati, “Innovative synthesis, structural characteristics, linear and nonlinear optical properties, and optoelectric parameters of newly developed A 2 ZnGeO 4 (A = K, Li) thin films,” RSC Adv., vol. 14, no. 33, pp. 23802–23815, 2024, doi: https://doi.org/10.1039/D4RA03742A.

D.-S. Kim and R. Syamsul, “Integrating machine learning with proof-of-authority-and-association for dynamic signer selection in blockchain networks,” ICT Express, Nov. 2024, doi: https://doi.org/10.1016/j.icte.2024.10.008.

C. Xu, J. Chen, and J. Li, “Numerical algorithm for determining serviceability live loads and its applications,” Struct. Saf., vol. 106, p. 102383, Jan. 2024, doi: https://doi.org/10.1016/j.strusafe.2023.102383.

S. Saha, B. Sarkar, and M. Sarkar, “Application of improved meta-heuristic algorithms for green preservation technology management to optimize dynamical investments and replenishment strategies,” Math. Comput. Simul., vol. 209, pp. 426–450, Jul. 2023, doi: https://doi.org/10.1016/j.matcom.2023.02.005.

F. Bayat Mastalinezhad, S. Osfouri, and R. Azin, “Production and characterization of biocrude from Persian Gulf Sargassum angustifolium using hydrothermal liquefaction: Process optimization by response surface methodology,” Biomass and Bioenergy, vol. 178, p. 106963, Nov. 2023, doi: https://doi.org/10.1016/j.biombioe.2023.106963.

J. Ramírez-Senent, J. H. García-Palacios, and I. M. Díaz, “Implementation of dynamics inversion algorithms in active vibration control systems: Practical guidelines,” Control Eng. Pract., vol. 141, p. 105746, Dec. 2023, doi: https://doi.org/10.1016/j.conengprac.2023.105746.

J. Lei et al., “Dual-adaptive energy management strategy design for fast start-up and thermal balance control of multi-stack solid oxide fuel cell combined heat and power system,” Energy Convers. Manag. X, vol. 20, p. 100461, Oct. 2023, doi: https://doi.org/10.1016/j.ecmx.2023.100461.

R. R. Kumar, P. J. Stauvermann, and S. A. Chand, “Investment analysis based on portfolio optimization: A case of Fiji’s stock market,” in Reference Module in Social Sciences, Elsevier, 2023. doi: https://doi.org/10.1016/B978-0-44-313776-1.00141-0.

M. Abdel-Basset, R. Mohamed, I. M. Hezam, K. M. Sallam, and I. A. Hameed, “Parameters identification of photovoltaic models using Lambert W-function and Newton-Raphson method collaborated with AI-based optimization techniques: A comparative study,” Expert Syst. Appl., vol. 255, p. 124777, Dec. 2024, doi: https://doi.org/10.1016/j.eswa.2024.124777.

Y. Wack, S. Serra, M. Baelmans, J.-M. Reneaume, and M. Blommaert, “Nonlinear topology optimization of District Heating Networks: A benchmark of a mixed-integer and a density-based approach,” Energy, vol. 278, p. 127977, Sep. 2023, doi: https://doi.org/10.1016/j.energy.2023.127977.